During old days, the way of buying was bartering. Goods were exchanged or bought with goods of the same value, then golds and silvers also became a form of currency. Today, currencies are in the form of small, tangible copper coins, and tearable papers which we call Dollars, Pounds, Euros, Peso and many more; however, there’s a unique currency that is rapidly gaining value in the public eye; it’s called cryptocurrency.

What is Cryptocurrency?

Cryptocurrency by definition is a digital currency in which encryption techniques are used to regulate the generation of units of currency and verify the transfer of funds — operating independently of a central bank.

All use cryptography to make advanced and secure transactions and transfer money across the globe. You are probably familiar with it or may have heard or read about it on the internet because, for the past year or two, cryptocurrency is creating a buzz.

Bitcoin was the first decentralized cryptocurrency in 2009. It was invented by an unknown and claimed Japanese developer, Satoshi Nakamoto. Since the decentralization of Bitcoin, cryptocurrency is gradually accepted on major sites like Overstock.com, OK Cupid, Pirate Bay, and WordPress.

Benefits of Cryptocurrency Usage

It’s not rare to doubt the value, security, and legitimation of cryptocurrency. Many—or even you—are having a second thought on whether to invest in cryptocurrency or not. Your first question may be; “is it safe?” or “why use it?”

Here are some of the benefits of cryptocurrency that will help you with your thoughts regarding investing or buying;

Benefit #1: Private and Highly Secured

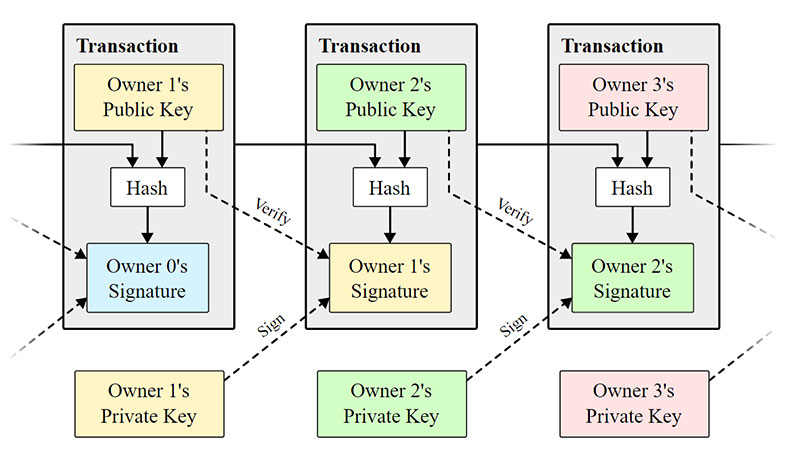

Cryptocurrency just needs two keys; a private and public keys. A public key or address is used to send and receive coins, and a private key is your personal key and is as large as 256 bits and can be designed with 64 characters of Hexadecimal. When both keys are combined into a math formula, you create a personalized certificate that is impossible to be duplicated and replicated.

There is also an essential technology that makes cryptocurrency secure; it’s called “blockchain.” When you make transactions, all data including your address and the transaction amount are converted into unbreakable code which is logged in on the blockchain that acts as a digital ledger or bookkeeper and recorder.

Benefit #2: Total Control

A peer-to-peer protocol monitors the cryptocurrency economy, which cannot be controlled or corrupted by governments and other organizations and is accessible to all no matter where or who we are. You can secure and control your own coins, with no central banks to block you with your withdrawals. You also don’t have to ask permissions before using cryptocurrency.

Benefit #3: Fast and Cheap Transaction

With a future for more improvements to look forward to, cryptocurrency’s transaction speed is remarkably fast, and with a low transaction cost. Bitcoin transactions only take 10-120 minutes for $3-7 per transaction, and Ripple—which is taking the lead when it comes to transaction speed—only takes 4 seconds per transaction. And transaction with checks and some—but not all—of the Credit/Debit Cards take at least 3-7 days for $15-20.

The Leading Cryptocurrencies

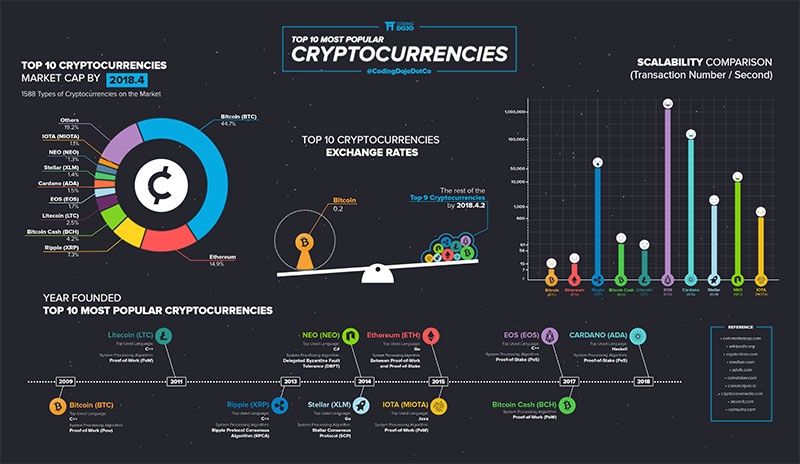

For almost ten years, cryptocurrency is increasing at high speed. Today, there are 1588 types of cryptocurrency on the market, and some celebrities are even using cryptocurrencies now, such as; Snoop Dog, Ashton Kutcher, Floyd Mayweather Jr. and even Paris Hilton.

Cryptocurrency Job Market

With its increasing growth and popularity, cryptocurrency proves to be more than just creating a buzz; it also creates jobs. According to the research from the job search site, Indeed, job posting mentioning “bitcoin,” “blockchain,” or “cryptocurrency,” have increased by 621% since November 2015. Supplies are increasing along with demand. Added to their report, a 1,065% growth in searches for jobs mentioning those three terms.

Of course, tech skills are essential in the crypto industry—for transactions are controlled and managed by codes. That’s why web developers and data scientists are essential jobs in the crypto industry.

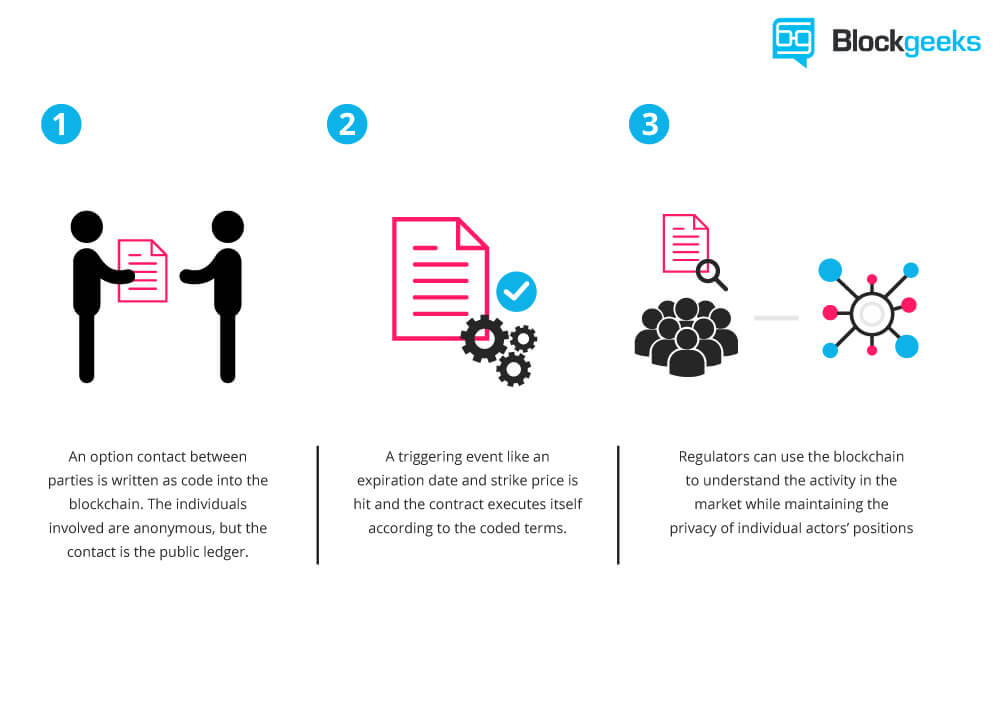

Web developers write and maintain codes, usually in the form of smart contract: computer protocols that enable cryptocurrency users to make transactions without a third party (like a financial institution). Some of the most popular languages used by web developers in the blockchain industry are JavaScript, Python, and Solidity.

Data scientists with strong analytical skills are needed to analyze transaction data. Harrison Brady, a communications specialist at Frontier Communications, a telecommunications company headquartered in Stamford, Connecticut stated; “Blockchain technology is relatively new and often misunderstood, which means that there is extremely high demand for experts in data science.”

Data scientist of Bitcoin and blockchain make almost $112k per year (source), web developers make around $110k per year, and junior software developers get around $66k (source) to $90k per year (source). Other jobs for cryptocurrency are; Financial Analyst, Machine learning engineer, Research Analyst, and Data Analyst.

Cryptocurrency Mining and Blockchain Scalability

Being popular as both a subject and activity, cryptocurrency mining or cryptomining—from the analogy of mining gold—is one of the most common ways to earn, collect and create coins. Of course, crypto coins aren’t like humans and animals; they won’t procreate and multiply by themselves for you. You have to work and be a crypto miner to earn and make coins. But here’s a little warning; cryptomining is far from easy and free.

Cryptomining is like the water to a plant; it’s the backbone of cryptocurrency network. It’s a process to update data, verify transactions and prevent fraud. And miners do that job; they check and validate transactions to make sure that users aren’t trying to illegally spend the same coin twice. Transactions are verified by solving difficult math puzzles and the first miner who solves a puzzle places the next block and update data on the blockchain. After all of that, the miner then claims the reward of newly generated coins—far from easy.

When cryptocurrency was starting, anyone with computers and internet access can participate in mining—the more miners, the faster transaction, and lesser fraud. The problem is, as the number of miners grows, the difficulty level of mining also increases, as well as the coins you make wouldn’t even pay your electric bills. That’s why mining equipment like ASIC Bitcoin miner was invented to adjust the difficulty level of cyptomining. Cryptomining equipment cost around $500 to almost $2000—far from free.

Because of the increasing number of miners, the cryptocurrency network—depending on the chosen cryptocurrency—changes the mining difficulty to ensure equal opportunities for every miner. Mining one block in 2009 would cost 50 Bitcoin, in 2012, it went down to 25 BTC, and in 2016, it was halved to 12.5 BTC. (source)

In addition to the difficulty level in cryptomining, scalability of Bitcoin—and other cryptocurrencies—is also becoming a problem. The problem arises from the size of the blocks in the blockchain which determines the limited number of transactions it can contain. The nature of the blockchain is to ensure a more secured transactions, but that slows down their speed.

Though they’re still faster than checks and other Credit/Debit card transactions, Ethereum manages just 20 transactions per second (tps), and Bitcoin processes only seven transactions per second—still way far from their great potential. Ripple, however, surpassed Visa with 24,000 tps and PayPal with 193 tps, and took the top position for the fastest transaction speed, with a whopping 50,000 transactions per second—giving us the example of what the future of transaction speed should be, and the hope for other cryptocurrencies with a scalability problem.

But as they say; when there’s a problem, there’s also always a solution. And there are some possible solutions or ways to address the scalability problem of the blockchain suggested by developers. Some of them include “Segregating Witness” or Segwit, an alternative solution proposed by Bitcoin developers to process more transaction without increasing the block size by moving the signature data to a separated block extension that would provide more space for more transactions in the original block.

Another possible solution is Sharding, a decomposition of a database into smaller units that work individually and at the same time. This method allows nodes to store a subset of the blockchain and verify transactions to increase the number of transaction that can be processed in the blockchain. And “micropayments channels,” is also a possible solution. Instead of broadcasting every transaction, broadcasting just the net effect of the transaction would decrease the transaction cost and the number of transactions on the blockchain, without reducing or affecting the number of cryptominers.

What’s Next?

From bartering, then to golds and silvers, to pennies and paper bills, now a virtual currency; money is matching the rapid and vast technology evolutions. And despite the poor performances and struggle in maintaining the number one position in the market, Bitcoin users and other digital money users still think the game is not yet over for cryptocurrency. However, creating and maintaining a public ledger—blockchain—is not at all easy. As it is now, skills to analyze data, and coding skills are highly demanded in the cryptocurrency universe. In fact, in 2017, blockchain ranked second in the top 20 fastest-growing job skills, and next on the list is also blockchain-related: Bitcoin.

The potential of cryptocurrency is still great, and many are still viewing it as the future of money. There is a call for help in improving the performance of blockchain and cryptocurrency transactions, and the call is for those who are already skilled data scientist, research analyst, and web developers. But if you aren’t one of them, there is also a call for you; to start now and learn how to read and write code, and participate in addressing and overcoming the shortcomings of a still growing cryptocurrency industry, and help—while earning big—for the future of cryptocurrency.

Well, as Helmut Schmidt stated, “the biggest room in this world is the room for improvements,” and there are still a lot of space in it for virtual money. To fill that huge space and reach the great potential of cryptocurrency, coding, and programming skills are undeniably essential.